Indicators on Transaction Advisory Services You Should Know

The Transaction Advisory Services Diaries

Table of ContentsSome Known Details About Transaction Advisory Services The Best Strategy To Use For Transaction Advisory ServicesAll About Transaction Advisory ServicesRumored Buzz on Transaction Advisory ServicesSome Known Details About Transaction Advisory Services

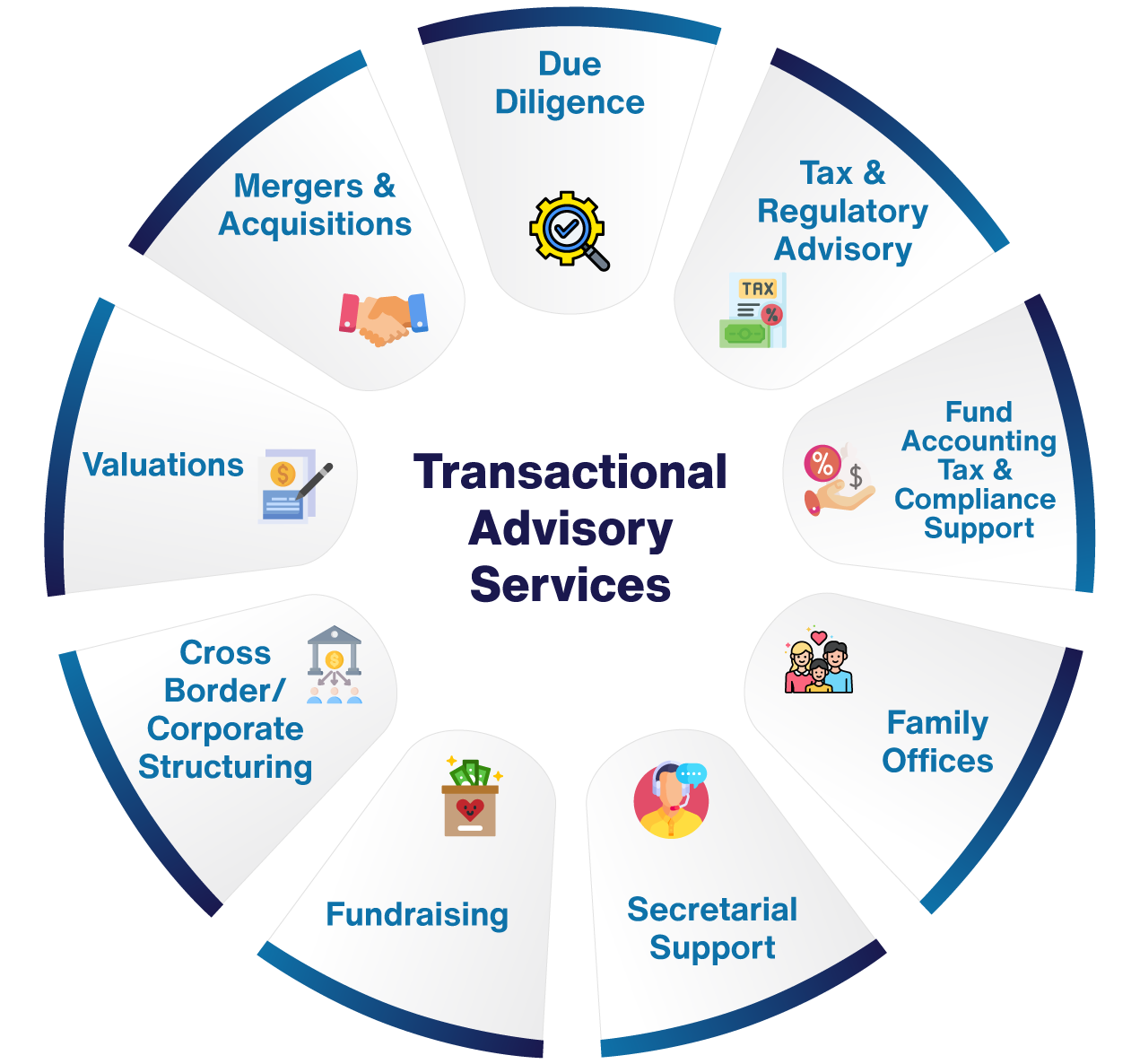

This step makes certain the business looks its best to possible purchasers. Getting the business's worth right is critical for an effective sale.Deal advisors step in to help by obtaining all the required information organized, responding to questions from purchasers, and preparing brows through to business's place. This constructs count on with customers and keeps the sale moving along. Getting the very best terms is crucial. Purchase experts use their know-how to help entrepreneur deal with challenging negotiations, meet customer assumptions, and framework offers that match the proprietor's objectives.

Meeting legal regulations is important in any type of organization sale. They assist service proprietors in planning for their next actions, whether it's retirement, beginning a brand-new endeavor, or managing their newfound wealth.

Deal experts bring a wide range of experience and expertise, guaranteeing that every facet of the sale is dealt with professionally. Through tactical prep work, appraisal, and arrangement, TAS aids entrepreneur attain the greatest possible list price. By making sure legal and regulatory conformity and handling due persistance along with various other offer staff member, deal advisors minimize potential threats and obligations.

The smart Trick of Transaction Advisory Services That Nobody is Talking About

By contrast, Large 4 TS teams: Work with (e.g., when a prospective purchaser is conducting due diligence, or when a bargain is closing and the buyer needs to incorporate the company and re-value the seller's Balance Sheet). Are with fees that are not linked to the bargain closing effectively. Make fees per involvement somewhere in the, which is less than what financial investment financial institutions earn also on "tiny offers" (however the collection likelihood is additionally a lot greater).

, yet they'll focus extra on bookkeeping and evaluation and much less on topics like LBO modeling., and "accountant just" subjects like trial equilibriums and just how to walk through occasions using debits and credits rather than financial declaration adjustments.

Transaction Advisory Services Fundamentals Explained

Specialists in the TS/ FDD teams may also talk to administration concerning every little thing over, and they'll compose a detailed record with their findings at the end of the procedure.

The hierarchy in Purchase Services differs a bit from the ones in investment banking and private equity jobs, and the general form appears like this: The entry-level duty, where you do a great deal of data and monetary analysis (2 years for a promotion from below). The following level up; comparable work, however you get the more intriguing bits (3 years for a promo).

In particular, it's difficult to get promoted past the Manager level because couple of people leave the job at that stage, and you require to start showing proof of your capability to generate income to advance. Allow's start with the hours and way of living because those are easier to define:. There are occasional late evenings and weekend work, however nothing like the agitated nature of financial investment banking.

There are cost-of-living adjustments, so anticipate reduced payment if you're in a cheaper area outside major financial (Transaction Advisory Services). For all placements other than Partner, the base pay consists of the mass of the total compensation; the year-end bonus offer may be a max of 30% of your base wage. Typically, the most effective means to raise your incomes is to change to a different firm and work out for a greater salary and incentive

Some Of Transaction Advisory Services

You might enter business growth, however investment financial gets extra difficult at this phase due to the fact that you'll be over-qualified for Expert roles. Company money is still an option. At this stage, you must just remain and make check my blog a run for a Partner-level role. If you wish to leave, possibly transfer to a client and execute their appraisals and due persistance in-house.

The primary trouble is that since: You typically need to sign up with an additional Huge 4 group, such as audit, and job there for a couple of years and after that relocate right into TS, job there for a couple of years and afterwards move into IB. And there's still no warranty of winning this IB function since it depends upon your area, clients, and the employing market at the time.

Longer-term, there is additionally some risk of and since reviewing a business's historic monetary information is not precisely rocket scientific research. Yes, people will certainly constantly need to be entailed, however with more advanced modern technology, lower headcounts could potentially website link support client involvements. That stated, the Transaction Services team beats audit in regards to pay, work, and departure possibilities.

If you liked this article, you may be curious about reading.

Transaction Advisory Services - Truths

Establish advanced financial frameworks that help in establishing the actual market value of a firm. Offer consultatory operate in relation to service appraisal to aid in negotiating and pricing structures. Explain the most ideal kind of the deal and the kind of consideration to use (cash, stock, earn out, and others).

Create action strategies see this here for risk and direct exposure that have actually been determined. Carry out integration planning to determine the process, system, and organizational adjustments that might be needed after the offer. Make numerical estimates of integration prices and advantages to evaluate the economic rationale of combination. Set standards for integrating departments, innovations, and organization procedures.

Identify potential reductions by minimizing DPO, DIO, and DSO. Evaluate the possible client base, sector verticals, and sales cycle. Take into consideration the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due persistance provides essential understandings into the performance of the firm to be acquired worrying danger assessment and value production. Determine short-term adjustments to finances, banks, and systems.